CardServ

Finance

End-to-End Payment Solutions for growing companies

Built to Serve Every Business Model

Online Business

AI can automate repetitive tasks, freeing up human resources for more strategic endeavors.

iGaming/Betting

Optimize performance with fast KYC,

custom checkout flows, real-time

settlements, and enterprise-grade

fraud protection.

Marketplaces & SaaS

Platforms

Integrate seamless, embedded

payments into your platform.

Empower users to transact securely

and create new revenue streams

effortlessly.

Payment Providers

Start or scale your PSP without the

overhead. We deliver the tech,

compliance, and ongoing support—so

you can focus on growing your

brand.

Global payment infrastructure for iGaming, forex, adult, and more. Fast onboarding, smart payouts, full compliance – built for high-risk businesses.

Scalable Payment Solutions Built for High-Risk Industries

CardServ Finance is a payment infrastructure provider built for complexity. iGaming operators, forex platforms, adult e-commerce, and other high-risk businesses use it to move money securely, stay compliant, and scale fast.

The platform combines global payment processing, real-time fraud tools, and white-label features into one powerful system – no patchwork integrations, no bottlenecks.

Backed by over 15 years of experience and a deep understanding of regulated markets, CardServ Finance offers more than just transactions. It gives growing companies the foundation to operate with confidence – across borders, risk profiles, and business models.

Fuel Your

Business Journey

From Launch to

Growth

Start Strong

Launch with confidence using a fast, reliable, and compliant payment setup — built to get your business off the ground quickly.

Monetize Efficiently

Enable multiple payment methods and streamline transactions to unlock new revenue streams and improve cash flow.

Scale Seamlessly

As your business grows, we scale with you — optimizing performance, reducing friction, and managing payments at every step.

Merchant Accounts

for High-Risk:

Custom setups for your industry and risk profile.

Key Services

Global Payment Processing: Accept cards, bank transfers, in 50+ markets.

Smart Payout Automation: Fast and secure disbursements with intelligent routing.

Global Payment Processing: Accept cards, bank transfers, in 50+ markets.

Real-Time Fraud & Risk Tools: Built-in AML, KYC/KYB, chargeback, and dispute management.

Single API Integration: Connect everything with one powerful API - easy and scalable.

Real-Time Fraud & Risk Tools: Built-in AML, KYC/KYB, chargeback, and dispute management.

Single API Integration:

Connect everything

with one powerful API -

easy and scalable.

Why Businesses Choose CardServ Finance

Over 15 years of team expertise

Advanced Anti-fraud tools

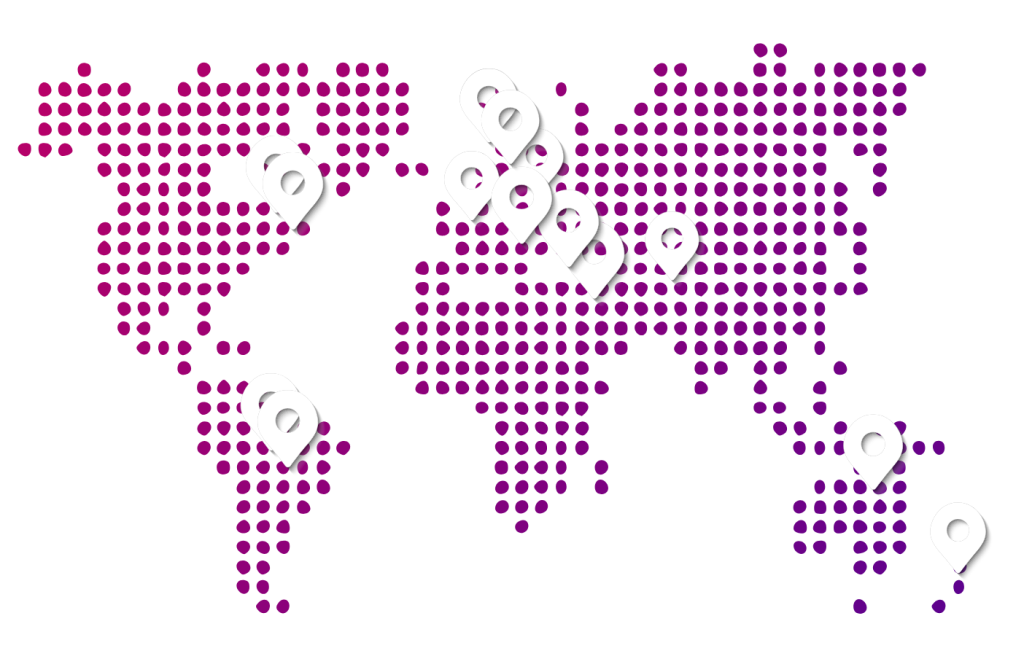

180+ countries

Automated KYC/KYB checks

24/7 dedicated support team

Multi-currency, one platform

Your Business Logic.

Our Payment Engine.

Limitless Results.

CardServ is an all-in-one payment infrastructure purpose-built for high-risk and scaling businesses. Whether you’re launching, growing, or optimizing, we help you connect with global payment providers, manage transactions, and scale without limits.

Industries We Serve:

Gaming & iGaming

Betting

e-Commerce

Forex

Adult e-Commerse

Casino

High Risk

Advantages

Gaming & iGaming

Gaming & iGaming

Gaming & iGaming

Gaming & iGaming

Gaming & iGaming

Variety of Synox Payment Methods

Powering Every Industry.

Education is the cornerstone of personal and societal growth, serving as a catalyst for enlightenment, innovation, progress. Through education, individuals gain knowledge.

Education is the cornerstone of personal and societal growth, serving as a catalyst for enlightenment, innovation, progress. Through education, individuals gain knowledge.

Education is the cornerstone of personal and societal growth, serving as a catalyst for enlightenment, innovation, progress. Through education, individuals gain knowledge.

Education is the cornerstone of personal and societal growth, serving as a catalyst for enlightenment, innovation, progress. Through education, individuals gain knowledge.

Elevate Your Payments with Us

-

Fast & Secure

Prioritizing Expediency, Safety in Every Transaction.

-

24/7 Live Support

24/7 Live Assistance: Support Always Available

-

Targeted Built API

Tailored API Customized Solutions for You

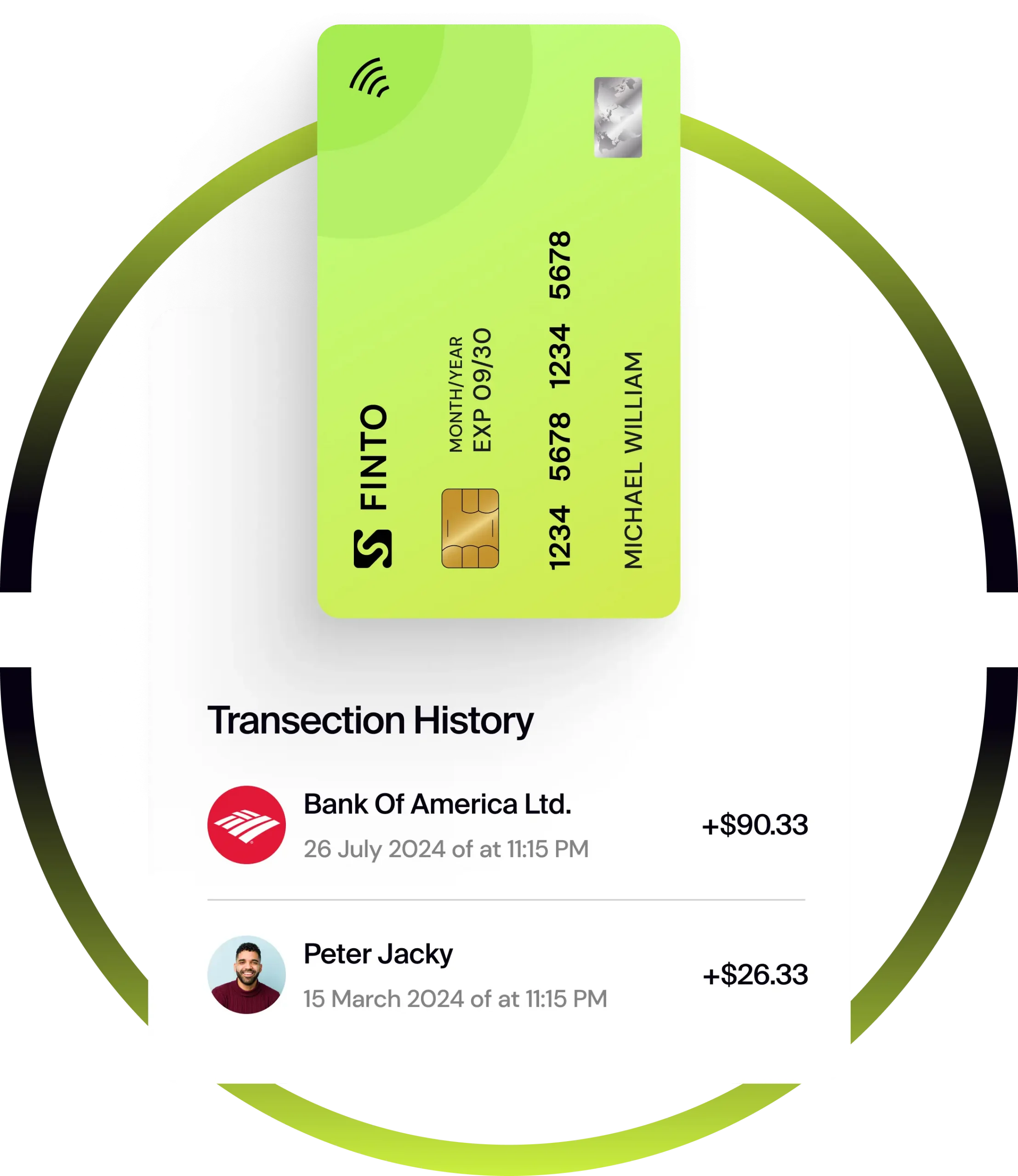

Clear Pricing for Transactions

General

Our Commission Deducted, Your Money Deposited —

- Single Banking Day to Your Merchant Account.

- When the funds turnover reaches $300,000.

-

1,9%

-

Get everything you need to manage payments

-

Finto mobile app is always available

-

No setup fees, monthly/hidden

Individual

Apply or write to the Chat to reduce the tariff if:

- Quick Deposits—Optimal for Speedy Transactions.

- When the funds turnover reaches $300,000.

-

Charity

0% -

Housing and public utilities, condominium associations

1% -

Online landing Working Process

2%

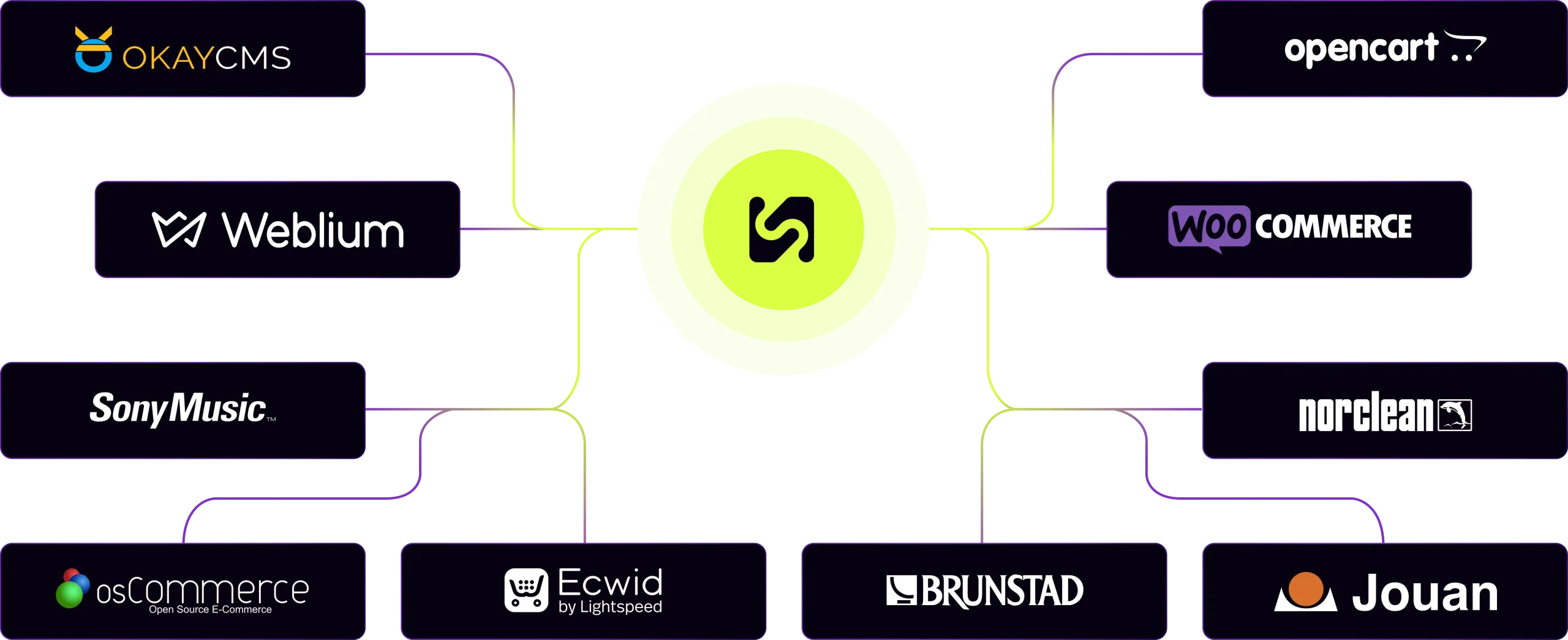

Our popular e-commerce CMS